Of the more than $30 million of unclaimed funds reported to the program during its first year, almost $650,000 has been claimed so far, leaving the remainder waiting to be reunited with its rightful owners.

February 1 is Unclaimed Property Day, which was developed by the National Association of Unclaimed Property Administrators (NAUPA) as an initiative to help raise awareness for and reunite consumers with unclaimed property. As a member of NAUPA, the Financial and Consumer Services Commission of New Brunswick (the Commission) is using the occasion to raise awareness of the province’s Unclaimed Property Program by collaborating with the New Brunswick Public Library Service.

New Brunswickers who do not have access to the internet at home are encouraged to visit their local library for access to computers and the internet to search FundsFinderNB.ca to see if they have unclaimed funds that belong to them.

“For anyone who doesn’t have access to a computer or the internet, we would like them to tap into these free resources offered at their local libraries and search FundsFinderNB.ca,” said Marissa Sollows, the Commission’s Director of Communications and Public Affairs.

According to the NAUPA, up to one in seven Americans has unclaimed property – money and funds forgotten in credit union accounts, uncashed cheques, investment accounts, security deposits and more.

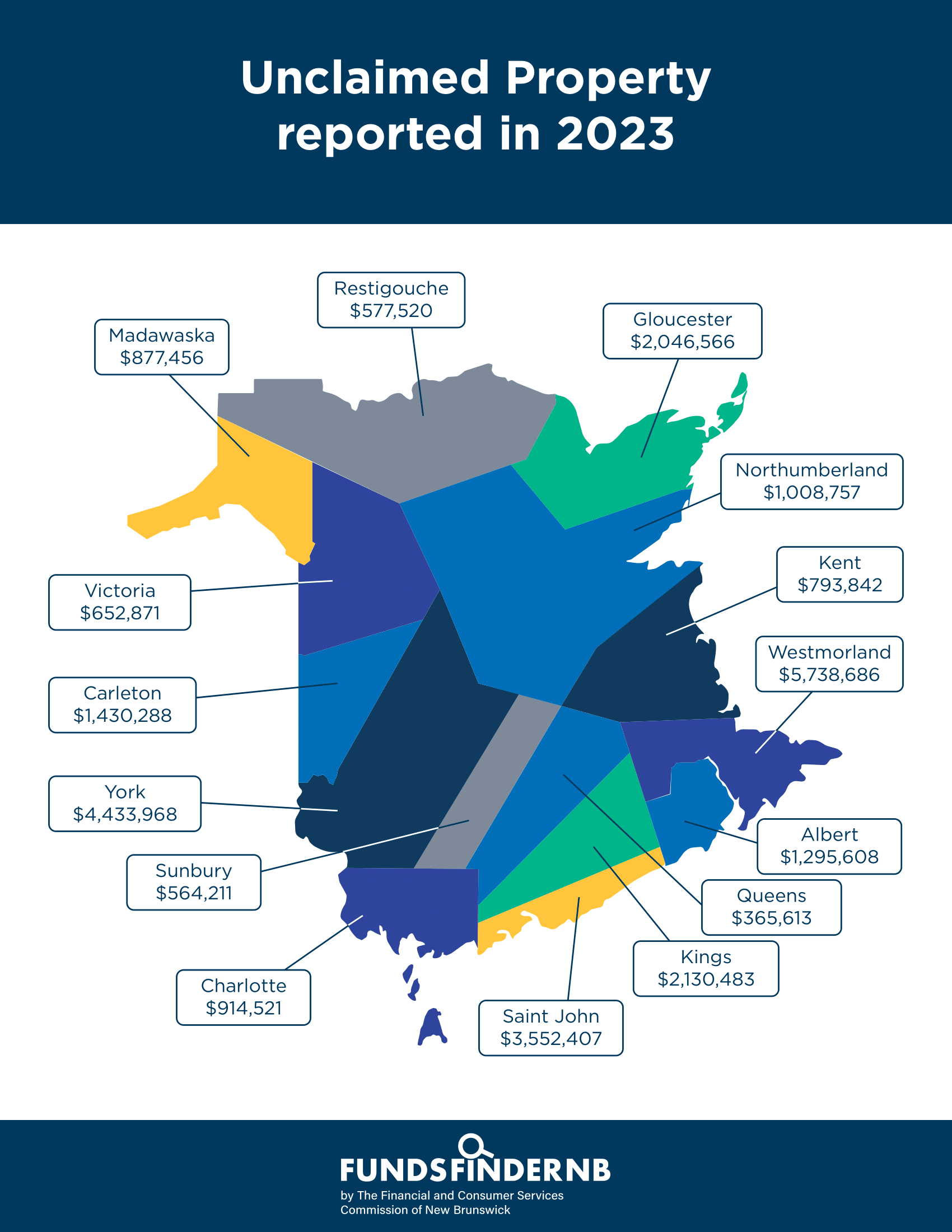

As of the end of 2023, the claimable amount reported by New Brunswick county was:

| County | Number of Unique Owners | Dollars Reported in 2023 |

| Albert | 645 | $1,295,607.83 |

| Carleton | 428 | $1,430,287.72 |

| Charlotte |

446 |

$914,521.06 |

| Gloucester | 1087 | $2,046,565.67 |

| Kent | 403 | $793,842.16 |

| Kings | 1356 | $2,130,482.99 |

| Madawaska | 342 | $877,455.50 |

| Northumberland | 737 | $1,008,757.34 |

| Queens | 147 | $365,613.39 |

| Restigouche | 460 | $577,519.65 |

| Saint John | 2198 | $3,552,406.51 |

| Sunbury | 567 | $564,211.28 |

| Victoria | 306 | $652,870.57 |

| Westmorland | 5104 | $5,738,685.84 |

| York | 4902 | $4,433,968.48 |

As more unclaimed funds are reported, these numbers will rise.

New Brunswickers can search for free on FundsFinderNB.ca to see if they have any unclaimed property. They simply need to enter a name in the search tool on the FundsFinderNB website, and the database will generate a list of any matching unclaimed funds reported to the program.

“The nature of the program is that funds are always being added,” said Sollows. “Every year, more money becomes unclaimed, resulting in more reports to the program. Consumers are encouraged to search their name at least once a year to see if any of it belongs to them, keeping in mind that new unclaimed funds are added to the database every year following the annual reporting period.”

During the reporting period, which runs January 1 to March 31 every year, businesses and other entities are required to report these funds to the program via FundsFinderNB.ca.

Virtually all businesses are holding unclaimed property that rightfully belongs to someone else, and reporting and remitting those funds to the program is mandatory.

Businesses can visit FundsFinderNB.ca for FAQs and resources including step-by-step guides, manuals and templates built to walk them through the reporting process.

More information about the program and how money becomes unclaimed can be found at FundsFinderNB.ca.

FCNB has the mandate to provide regulatory services that protect the public interest, enhance public confidence and promote understanding of the regulated sectors through educational programs. It is responsible for the administration and enforcement of provincial legislation regulating mortgage brokers, payday lenders, real estate, securities, insurance, pensions, credit unions, trust and loan companies, cooperatives, and a wide range of other consumer legislation. It is an independent Crown corporation funded by the regulatory fees and assessments paid by the regulated sectors. Online educational tools and resources are available at www.fcnb.ca.